Eneva is an integrated energy company, operating mainly on three important fronts:

Exploration & Production

Exploration & Production

Private natural gas operator, with onshore gas and oil fields in the Parnaíba (Maranhão) and Amazonas and other E&P assets in the Paraná and Solimões basins.

Power Generation

Power Generation

Operational assets in energy generation total 6.3 GW, delivering energy to Brazilian electrical system in a safe and competitive format

Energy Solutions

Energy Solutions

Operating in the free energy market and in the natural gas market, providing complete energy solutions in a competitive way for our clients.

R2W

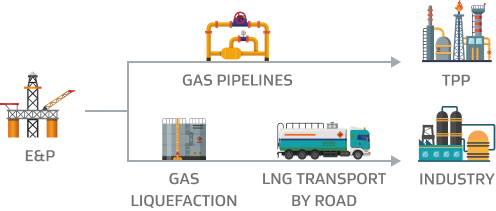

Eneva is a pioneer in the R2W (Reservoir-to-Wire) integrated business model, operating from natural gas exploration to power generation and the commercialization of gas and energy. The performance in the entire value chain gives Eneva a growth platform to capture a wide variety of opportunities in strategic areas in the energy sector.

Take a look at how the company operates the R2W model in two different ways.

TPPs located near gas production units, connected by their own pipelines.

Gas liquefaction and LNG transportation by road to UTE Jaguatirica II, in Roraima, and to industry in Maranhão.

Exploration & Production

The Company has a current production capacity of 9 MM m³ of gas per day, being 8.4 MM m³ per day in the Parnaíba Basin and

0.6 MM m³ per day in the Amazonas Basin.

Eneva has concession contracts for hydrocarbon exploration and production in more than 64,000 km² in four onshore sedimentary basins (Parnaíba, Amazonas, Solimões, and Paraná), which are at different exploratory stages.

Natural Gas: the transition fuel that offers flexibility, security, and contributes to the tariff modicity and to a more renewable national energy matrix

Natural gas plays a fundamental role in the transition to a cleaner energy matrix, being less polluting and offering a more competitive cost to final consumers, among the other fossil sources. In addition, it is used to support the growth of renewable sources, which are intermittent and need the flexible generation that thermal plants provide to guarantee the security of the system’s supply.

In this way, Eneva has an active participation in Brazil’s energy transition, with the activities of exploration and production of natural gas and the generation of electricity from this fuel, always seeking to act with maximum efficiency and pursuing the best practices to reduce emissions in its operations.

Currently, the Company has a contracted generation capacity of 6.0 GW, which includes the Parnaíba VI, Azulão 1 and 2 power plants, currently under construction. Additionally, the park comprises 10 thermal power plants and Futura 1, all located in the North and Northeast regions of the country.

Sustainability Commitment

The Company released the second report produced in the Integrated Report format, after three annual editions of Sustainability Reports, reporting the operational, economic and socio-environmental performance for the year 2023. With objectivity, transparency and a focus on the quality of the information provided, the document was prepared in accordance with the standards and indicators of the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), covering the business model, policies, commitments and actions relevant to our priority stakeholders.

Learn MoreAt Eneva, we work for a more sustainable tomorrow. We are prepared to go beyond, seeking clean and stable energy solutions for all. We want to lead the energy transition in a fair and inclusive manner, contributing to the development of the municipalities where we operate, reducing emissions, and investing more and more in the conservation of the Legal Amazon. Our commitment is to tomorrow. It is with this energy that we are generating value for society and building a better tomorrow for all.